Cash Out vs. Homestyle Renovation Loan: Picking the Perfect Loan for Your Needs

9/5/2024

Dreaming of a kitchen makeover or a backyard oasis? Let’s break down two popular options to fund your home improvement project: cash-out refinancing and a homestyle renovation loan.

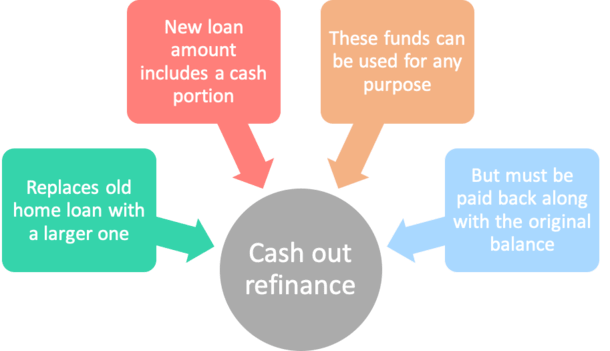

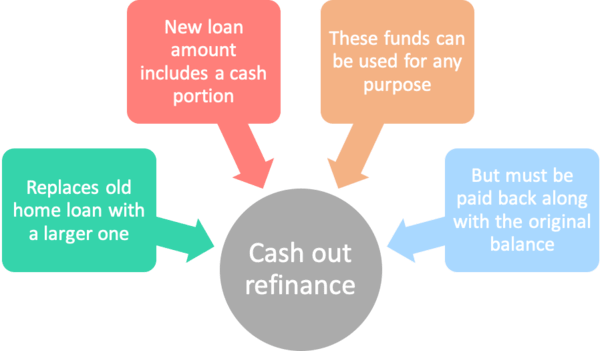

A cash-out refinance replaces your current mortgage with a new one for a larger amount, allowing you to pocket the difference. This can be a great option if:

- You have significant equity in your home: The more equity, the more cash you can access.

- You want to consolidate debt: Use the funds to pay off high-interest credit cards or other loans.

- You're looking to lower your interest rate: If interest rates have dropped since you took out your original mortgage, refinancing could save you money.

However, keep in mind that cash-out refinancing:

- Increases your mortgage balance: This means higher monthly payments.

- Involves closing costs: These can add up.

- Might lengthen your loan term: This could increase the total interest paid over the life of the loan.

A homestyle renovation loan combines your mortgage and renovation costs into one convenient package. This option is ideal if:

- You’re buying a home that needs repairs: This loan can cover both the purchase price and renovation costs.

- You want to finance specific home improvements: This loan is designed for renovations, not other expenses.

- You prefer a single monthly payment: Simplifies your budgeting.

But consider these factors:

- Limited to renovation costs: You can't use the funds for other purposes.

- Potential for higher interest rates: Compared to a traditional mortgage, you might pay a slightly higher interest rate.

- Appraisal requirements: Your home’s value after renovations will determine the loan amount.

The best choice depends on your financial situation and renovation goals.

- If you have substantial equity and want flexibility, a cash-out refinance might be the way to go.

- If you're purchasing a home that needs work or prefer a streamlined process, a homestyle renovation loan is a good option.

Remember to shop around and compare rates from different lenders.

#homeownership #renovation #millennials #mortgage #DIY #homeimprovement #finance