Beyond the Basics: Understanding Eligibility for a VA Renovation Loan

10/23/2024

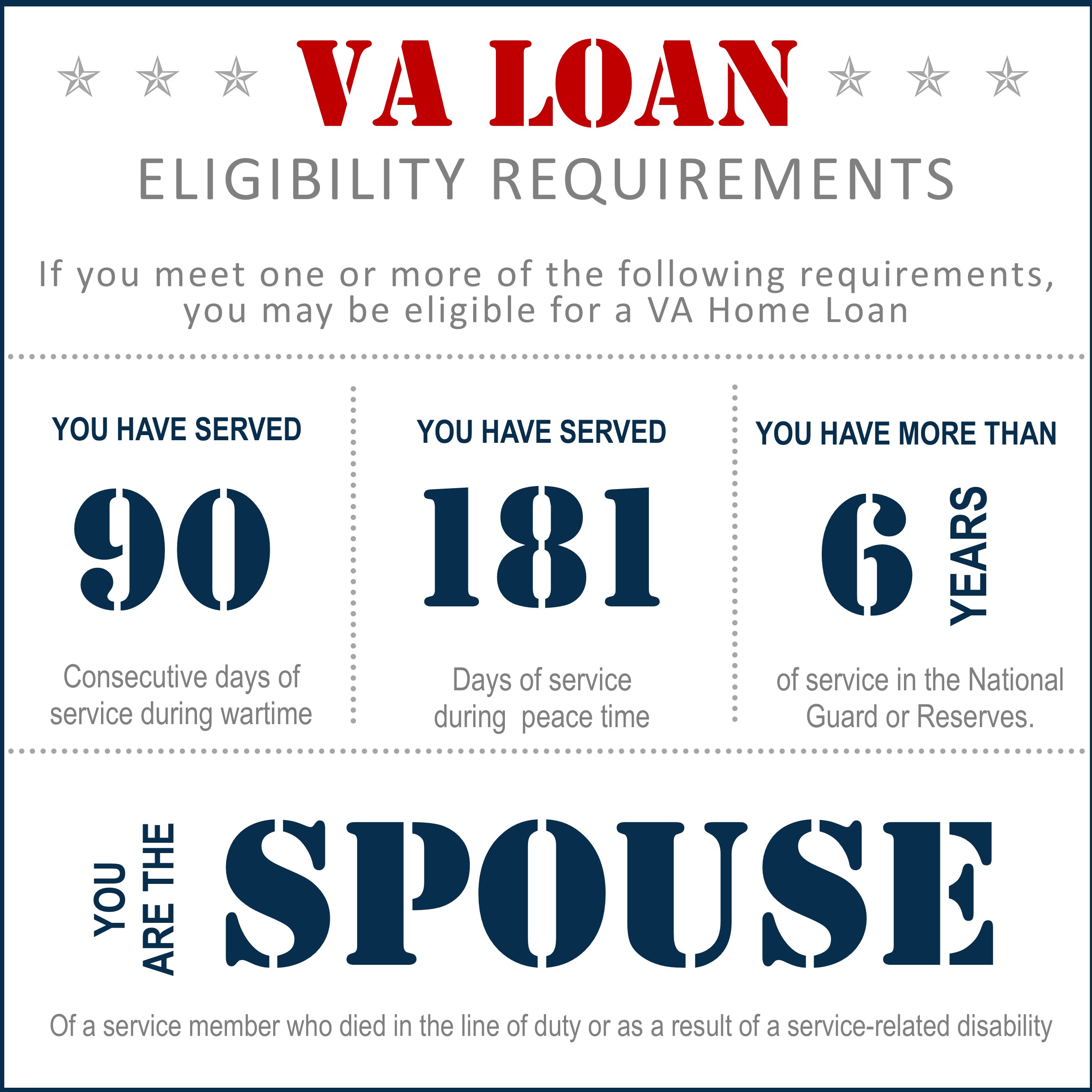

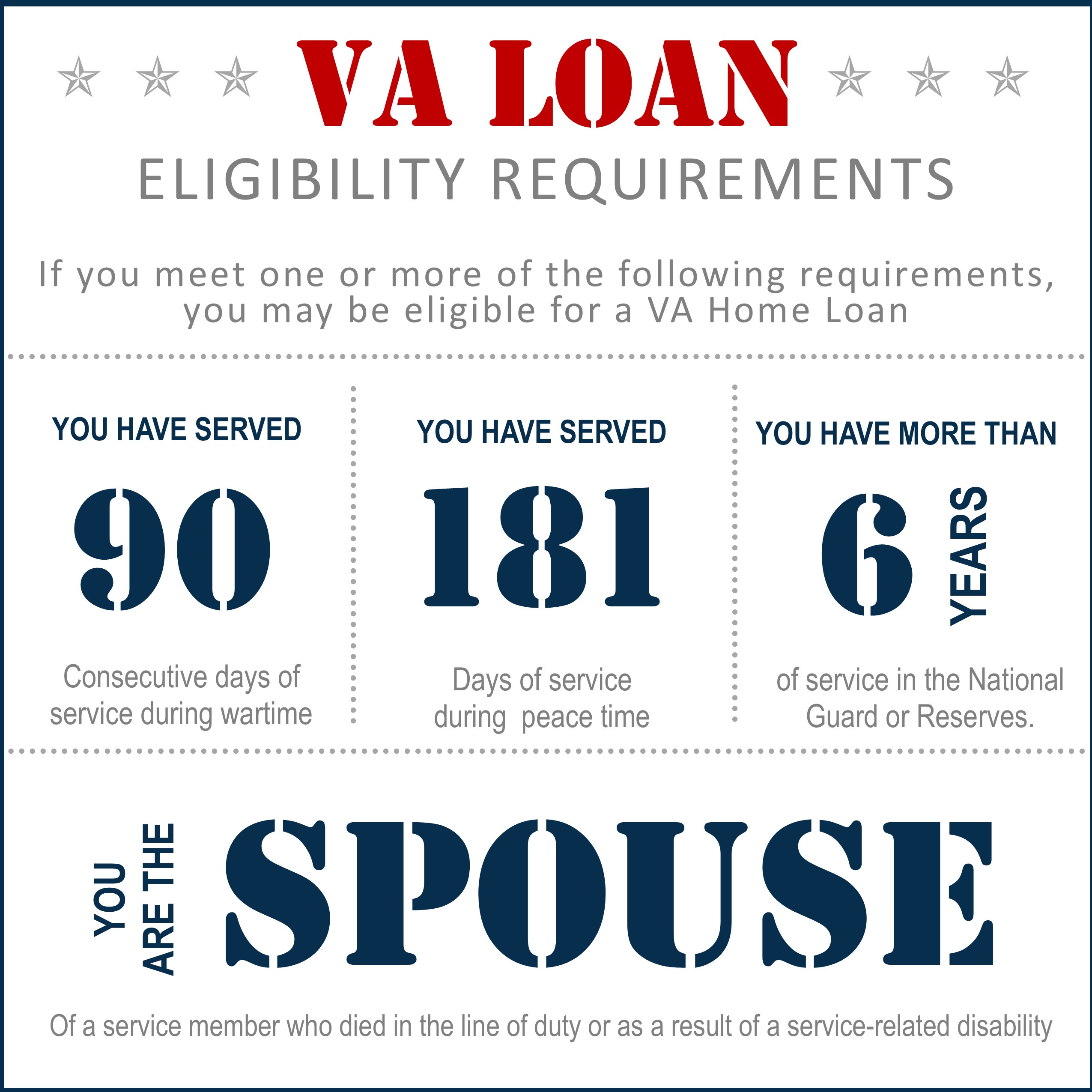

To qualify for a VA renovation loan, veterans must meet specific criteria. Let's break down the key eligibility requirements:

- Active Duty: Currently serving on active duty.

- Veterans: Honorable discharge after at least 90 consecutive days of active service during wartime or 181 days during peacetime.

- National Guard and Reserves: At least six years of service.

- Surviving Spouses: Spouses of veterans who died in service or from service-connected disabilities may also qualify.

A COE is required to obtain a VA loan. This document verifies your eligibility based on your military service. You can request a COE online or through your local VA regional office.

While the VA doesn't set a minimum credit score, lenders typically require a score of at least 620. You'll also need to demonstrate a stable income and meet debt-to-income ratio requirements.

- Primary Residence: The property must be your primary residence after the renovation.

- Eligible Repairs: Renovations must improve the property's livability, safety, and use, not just cosmetic changes. Major structural modifications or additions may not qualify.

- Contractor Approval: The contractor you choose must meet VA requirements.

- Property Appraisal: A VA-approved appraiser will assess the property's value.

- Disbursement Process: Loan funds are typically released in stages as the renovation progresses.

Understanding these eligibility requirements is essential for a smooth renovation process. If you meet the criteria, a VA renovation loan can be a powerful tool for transforming your home.

Would you like to explore specific renovation projects that qualify for VA renovation loans, or perhaps discuss potential challenges and solutions?