VA Renovation Loan vs. FHA 203k: Which Loan is Right for You as a Veteran?

10/26/2024

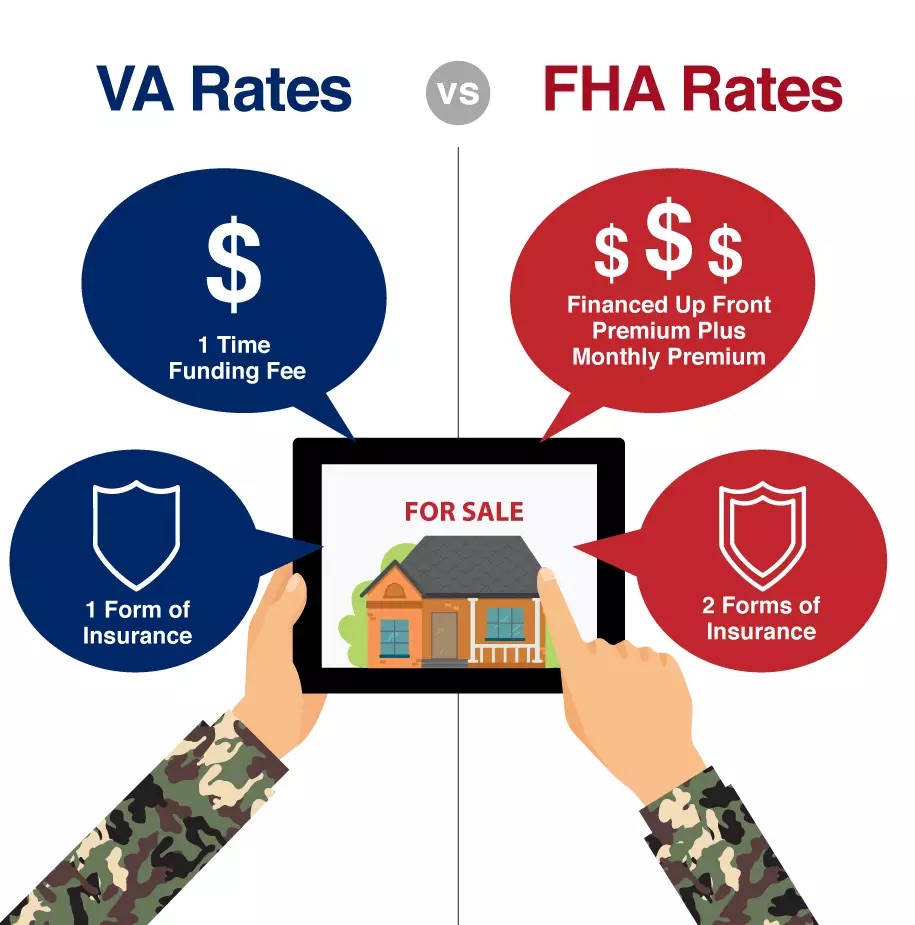

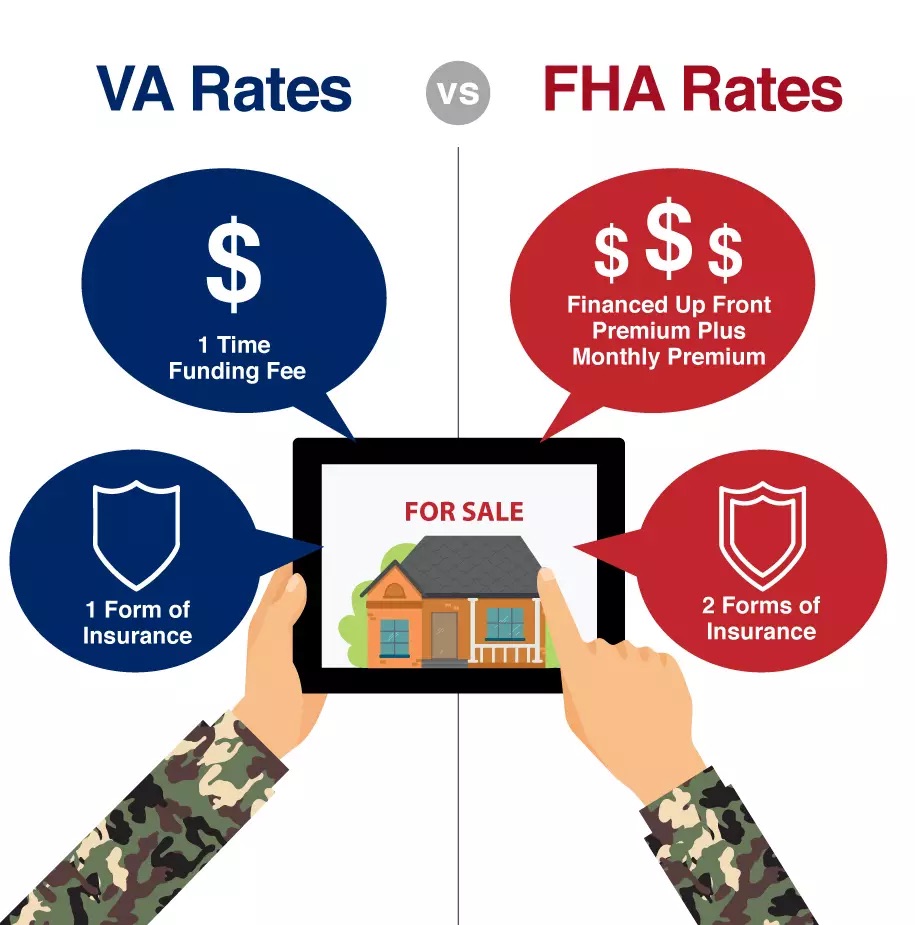

Both VA renovation loans and FHA 203(k) loans offer veterans the opportunity to finance home purchases and renovations in a single mortgage. However, there are key differences between the two.

VA Renovation Loan

- No down payment required

- Competitive interest rates

- Government-backed guarantee

- Fewer lenders offer this option

FHA 203(k) Loan

- Requires a down payment of 3.5%

- Interest rates typically higher than VA loans

- Government-insured loan

- More lenders offer this option

Which is right for you?

- Choose a VA renovation loan if: You qualify for a VA loan, want to avoid a down payment, and prefer lower interest rates.

- Choose an FHA 203(k) loan if: You need a larger renovation budget, prefer a loan with more lender options, or are comfortable with a down payment.

Important Considerations:

- Renovation scope: VA renovation loans typically focus on smaller renovations, while FHA 203(k) loans can handle more extensive projects.

- Credit score: Both loan types require a decent credit score.

- Closing costs: Compare closing costs for both loan options.

Ultimately, the best choice depends on your individual financial situation and renovation needs. Consulting with a VA-approved lender can help you determine the best option for you.

Would you like to explore specific renovation projects that qualify for either loan type, or perhaps discuss the pros and cons of each loan in more detail?