VA Loan Limits and Renovation Costs: How Much Can You Borrow?

11/1/2024

Understanding the limits of your VA renovation loan is crucial for effective budgeting. Let's break down the key factors influencing how much you can borrow.

VA Loan Limits

- County-Based Limits: VA loan limits vary by county, reflecting the local housing market.

- Entitlement: Your VA entitlement determines the maximum loan amount you can qualify for without a down payment.

- Renovation Costs: The cost of your renovations will be added to the purchase price to determine the total loan amount.

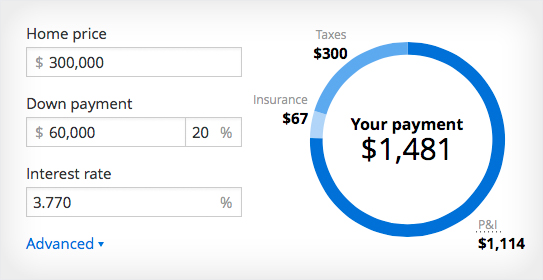

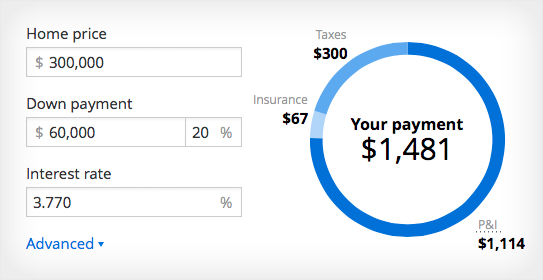

Calculating Your Loan Amount

- As-Completed Value: The lender will estimate the property's value after the renovations are complete.

- Renovation Budget: Clearly outline your renovation costs to determine the total loan amount needed.

- VA Entitlement: Ensure your entitlement covers the total loan amount.

Additional Factors

- Credit Score: A higher credit score may qualify you for better loan terms.

- Income: Your income will influence your ability to afford the monthly mortgage payment.

- Debt-to-Income Ratio: This ratio helps determine your loan eligibility.

Important Note: While VA loans offer flexibility, it's essential to create a realistic budget and consider potential cost overruns.

Tips for Maximizing Your Loan Amount

- Prioritize Necessary Repairs: Focus on essential repairs to maximize your loan amount for desired renovations.

- Shop Around for Contractors: Competitive bids can help reduce overall costs.

- Explore DIY Options: Completing some tasks yourself can save money.

By understanding these factors and working closely with your lender, you can make the most of your VA renovation loan to create your dream home.

Would you like to explore strategies for maximizing your renovation budget while staying within loan limits?