Unlocking Your Dream Home: Who Qualifies for an FHA 203k Loan?

2/1/2024

Remember that charming fixer-upper with endless potential, but wondered if you could turn that "diamond in the rough" into your sparkling dream home? Well, worry not, aspiring homeowners, because the FHA 203k loan might just be your magic key! But before you grab your tool belt and start planning renovations, let's unlock the door to eligibility and see if you fit the profile for this homeownership game-changer.

Borrower Eligibility:

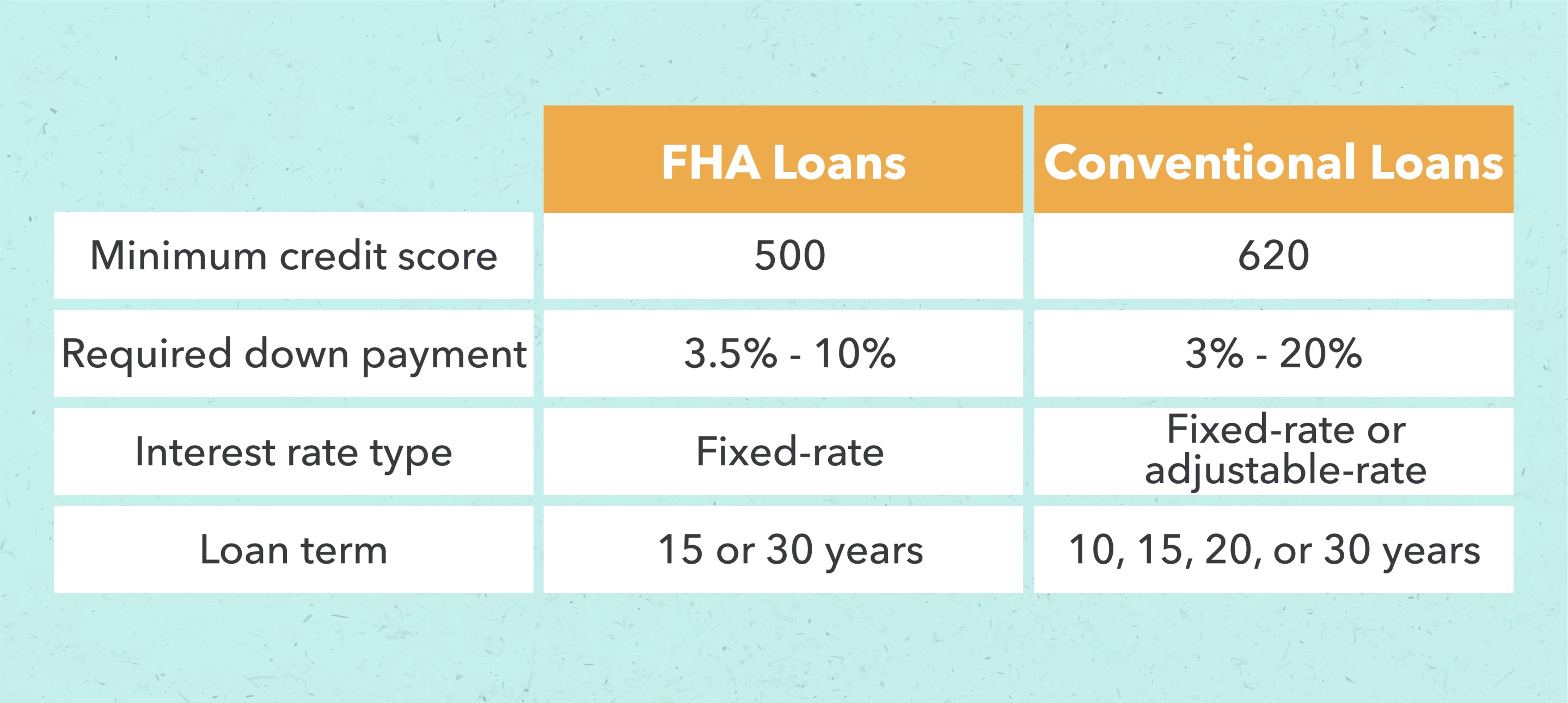

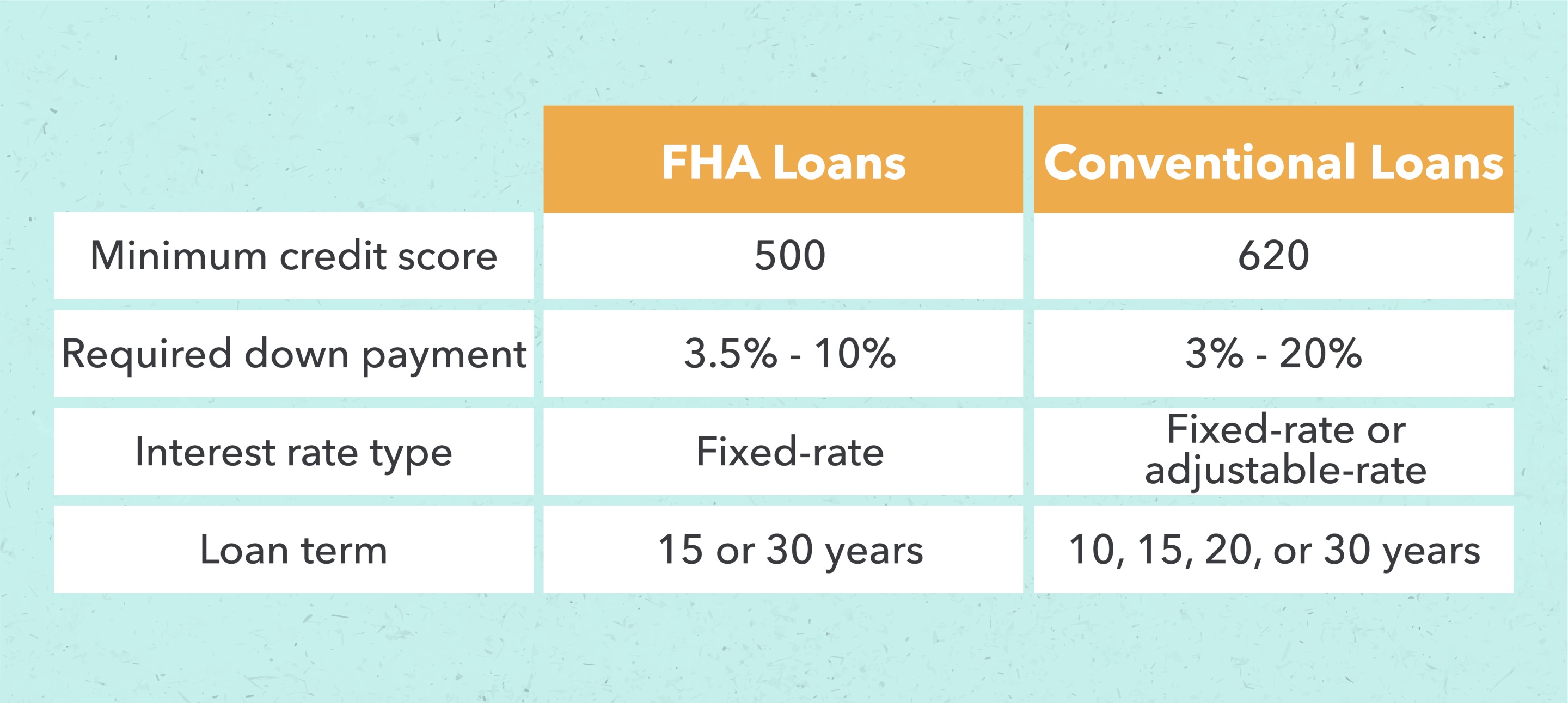

- Credit Score: While the minimum score varies by lender, most require at least 500. Higher scores typically qualify for lower interest rates, so aim for 580 or above for optimal terms.

- Debt-to-Income Ratio (DTI): This measures your monthly debt payments compared to your gross income. Ideally, keep your DTI below 43% for a smoother loan approval process.

- Employment History: Steady employment and a verifiable income are crucial. Lenders typically prefer at least two years of employment history in the same field.

- Down Payment: This varies depending on your credit score. With a score of 580 or higher, you can put down as low as 3.5%. Lower scores might require a 10% down payment.

Property Eligibility:

- Property Type: Single-family homes, townhomes, two-to-four-family units, and some eligible accessory dwelling units are good candidates. Mobile homes and properties requiring extensive structural work typically don't qualify.

- Property Condition: While fixer-uppers are welcomed, the property must be structurally sound and habitable. Severe structural issues or uninhabitable conditions disqualify it.

- Location: The property must be located in an area with FHA-approved mortgage limits. You can easily find these limits online or consult with your lender.

Beyond the Basics:

- Refinance Options: Did you already fall in love with a home in need of TLC? Don't fret! Certain circumstances allow you to refinance your existing mortgage into an FHA 203k loan and make those dream renovations a reality.

- Streamline vs. Standard: The 203k program comes in two flavors: Standard for major renovations and Streamline for smaller cosmetic updates. Choose the one that best suits your project's scope and complexity.

- Remember: Every lender has specific requirements, so consult with a mortgage professional familiar with the FHA 203k program. They can help you navigate the eligibility maze, assess your situation, and ensure you're on the right track to unlocking your dream home.

So, if you have a vision, a toolbox, and the determination to transform a fixer-upper into your haven, the FHA 203k loan might just be the missing piece. With careful planning and the right guidance, you can turn your fixer-upper dreams into a reality, brick by beautiful brick!

Let us know in the comments below – what type of fixer-upper renovations are you dreaming of?